Originally posted on Steem (@phaelosopher)

I am still new to the CryptoSphere, having only begun studying the phenomenon and its social *implications* of bitcoin and friends in February of this year. Every day is discovery for me, even at “three score and five” times around the sun. The social implications of the bitcoin and alt-coin ascendancy *at this time* is as large as the other issues that have captured my attention, analysis, imagination, and energy over the past ten years.

- Health and healing

- The nature of water and its restoration

- The effects of imbalance on health, medicine, agriculture, and environment, and its restoration

- What can be fixed, and how (beginning with ourselves)

In this age of specialization, compartmentalization, and narrow focus, it’s a great contrast to learn that our problems, as well as the solutions are all interrelated, and that when you take an impartial look at *the whole*, solutions become fairly obvious.

‘Specialists” focus on the “problem”, thoroughly trained to see and treat it as *the enemy*. They even bestow evil intent, such as when members of the medical profession refer to tumors “malignant”. Ever respecting, trusting and sold on the notion that they know far more about such dastardly things than us, we give them *carte blanche* liberty to decimate our bodies with chemical additives, or slice and dice our body surgically. These habits run deep. We allow medical personnel to decimate our children with vaccines at birth, as our parents allowed our precious ecosystems to be decimated, and their parents did with them.

These chemicals didn’t kill us outright. That wouldn’t have been good for business, nor good “population management”, as plausible deniability would be thrown out the window. However, if packaged properly, chemicals are quite effective as “time release” mechanisms to facilitate cognitive degradation and dysfunction, and predictable disease pathologies that we will later be sold on needing to “fight” or “battle”… *if* we can afford the treatment, or are “blessed” to have health insurance “coverage”.

Little does the average person know how preventable and reversible most disease pathologies are, particularly when true causes are discovered and *balance* is restored.

Every one of the topics mentioned above could fill books unto themselves, but this all relates to what is probably my biggest “A HAH!” moment… actually moments, because they haven’t stopped coming… as my appreciation of the importance of this cascade of change represented by bitcoin and its encrypted offspring, grow.

A Subtle Distinction Becomes Huge

My appreciation that cryptos are not *money* is raised to an entirely new level of significance and meaning because “money” is not what we think it is.

We tend to think of money as objects or commodities that have intrinsic value. This seemed plausible, and with no alternatives, there was no point, nor need for debate.

However, Benjamin Franklin’s expression on the $100 bill below seems telling today, particularly in his eyes. They appear to be wondering, “Will they ever realize we’re being taken on a grand scale?”

Our perceptions about money, the monetary system, and people who have lots of money, are all carefully, systematically, and effectively orchestrated that it can indeed be used to control entire nations. “Money” is not our friend, for its value is *not* in our hands. Money’s value is a sliding scale, that will *always* “slip” further down.

Our mistake is to tie our value to money, as the Fed tied it to oil. The value of money is actually tied to us too; “the full faith and credit of the people of the United States.” But we don’t get the credit. Federal Reserve Notes have “In God We Trust” printed on them, but let them try to get God to settle the national debt.

That won’t happen because the national debt can’t be settled. That’s what disease and wars are for. Get rid of everyone who cared about such things, agree to not talk about it, and set the system up once again.

Money’s value *can* go up, as the graphic above shows that it has. However, that was manipulation from the same agency that manipulates it now. The rise in the dollar’s buying power, after its first precipitous drop (1913-1921), led directly (1) to the Great Depression, and (2) to the confiscation of all privately held gold by the government, which citizens were to deliver to the privately-owned and operated Federal Reserve Corporation.

Money’s value *can* go up, as the graphic above shows that it has. However, that was manipulation from the same agency that manipulates it now. The rise in the dollar’s buying power, after its first precipitous drop (1913-1921), led directly (1) to the Great Depression, and (2) to the confiscation of all privately held gold by the government, which citizens were to deliver to the privately-owned and operated Federal Reserve Corporation.

“Money” works for the benefit and advantage of the owners and operators of the Federal Reserve and its system, because it is their property, not ours.

This 1996 documentary by Bill Still, *The Money Masters*, is well worth the 3+ hour runtime, even if you have to do it in installments.

I’ve included screen shots of a few quotes included in the documentary.

Here are two more choice quotes by Bill Still:

> To the central bankers the political issues of war don’t matter nearly as much as the profit potential, and nothing creates debts like warfare.

> England was the best example at that time. During the 119-year period between the founding of the Bank of England and Napoleon’s defeat at Waterloo, England had been at war for 56 years, and much of the remaining time she’d been preparing for war.

A BIG Difference

As it has been used throughout the course of history, both in the United States and abroad, we should be thrilled to proclaim that bitcoin and other blockchain-based crypts are *not* “money”, as it is a debt instrument, not only for the masses, but of nations, *created by us*, but “owned and operated” by the banking cartels.

When the Securities Exchange Commission (SEC) rejected the Winklevoss twin’s application to give bitcoin an Exchange Traded Fund (ETF) status, many observers thought that would be the pin to burst the “bubble”, where its value would fall because of notions dashed of bitcoin becoming a “legitimate” currency. The price did decline for a bit… then resumed its climb, as though unphased by the ruling.

We should stop seeking “validation” of legitimacy for bitcoin or other alt-coins by trying to “prop” a money-based regulatory agency on top of it.

The SEC ruling was a blessing; an indicator that the forces driving the upward price movement are *not* subject or subservient to either SEC or FED. Some manipulation is possible, but even that is lessened with wider adoption… not just of bitcoin, but ethereum, Steem, and the rest. In other words, as we ween ourselves from the use of “money”.

Not that money itself is “bad”. The way it has been used, and by whom, is the problem. *That* is the control structure bubble that needs to burst. The banks and their servant, the U.S. government are placing a dragnet over various access points and vehicles that masses of people might use to acquire bitcoin. Why? More adoption, acquisition, accrual, and store of encrypted Value Instruments, coupled with the ability to convert them into forms that allow the exchange of goods and services, means less *need* for one of the fundamental ways that money (and debt) is created, *loans*.

200,000 Troops Deployed in 177 Countries: Why?

The U.S. Defense Department has become the Offense Department, that receives billions in budgeted monies each year, and *misplaces* trillions more. Even though they report the mismanagement, no one calls them on. That leads me to believe that is not “mismanagement”. No one “misplaces” $2-6 trillion dollars *in one year*. These actions are taken because the perpetrators *know* that they can.

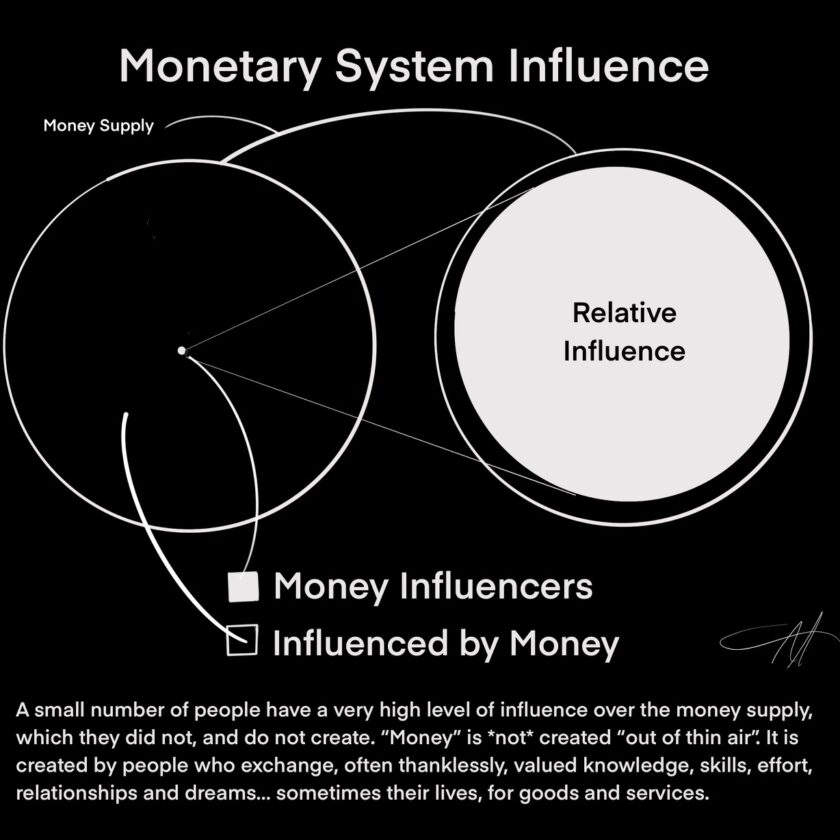

Money is used to create “debt” out of thin air for the likes of you and me, as well as for nations. It is then applied to numerous initiatives to convince you that the world and some its people are dangerous, and we should be afraid *enough* for everyone else to surrender to increasing intrusion and control by the actual creators of the problem, appointing them as our “guardians”.

Money has been used to fund both sides of *every* war in recent history, going back a few hundred years. All the while *we* get sprayed, injected, have chemicals added to the water supply, denatured our foods, and when we got sick, as someone knew we inevitably would, even more money was used to pay for more.

For sure, cryptocurrencies are *not* money. They won’t necessarily stop that insane behavior cycle. However, every bit of “money” that we no longer need to spend, deflates a monetary system that has created and fed off human suffering for far too long.