This might sound obvious, nit picky or not important, but bitcoin isn’t money. None of the alt-coins are money. They function like money, but they’re not. They are actually better at being what we think of as “money,” than money is.

This insight has been percolating in and around my mind for some time. What to do with it, has been the question.

Simple conversation would be a good place to start, particularly if we’re armed with appropriate terms for bitcoin and its alt-siblings. I suggest that a more appropriate term for these emerging agents of change, is Value Instrument, or VI.

The value of bitcoin and other VI’s, is that they record, hold, and protect the record of an exchange (another word for “trade”) of value between people and companies. They do so without need for intermediaries and intercessors such as banks and government minions.

Has anyone noticed that “terror” has become the default go to reason for government to be in the middle of, or overseer on virtually every aspect of life? And while we are expected to exercise financial responsibility, ever notice how neither banks nor government minions expect themselves to?

They will spend or misplace trillions of dollars to build bombs and other weapons of destruction and deploy it to destroy other cultures, but make little time to talk or even hint at a desire for peace, or to fix festering problems right here at home. That’s because “money” is a tool… not of value, but control.

Where is the Value?

Money has no intrinsic value of its own, and does not hold the value given to it. Just observe any chart of purchasing power and see how it decline. I submit that this is not by happenstance, but of purposeful intent. The intent is to create two things,a perpetual state of lack or scarcity by the masses, which create an ongoing need for “loans”, which further dilute the overall purchasing power of the general population.

This keeps people in a perpetual mindset that they have to work hard to keep up with the decline. A value instrument is free of such manipulative practices or agendas. Hence, as it’s effectiveness at protecting the record of a value exchange was demonstrated time and time again, people began using bitcoin and seeing how it could enhance other aspects of life. With greater adoption, investment ensued, and its “value” climbed.

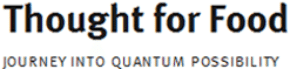

None of these developments made bitcoins into “money”. Money is a *proxy* for value exchanges between people and companies. What we have come to overlook, is who and what the real value is (or are). The real value are people; the most important, yet overlooked part of the equation. Without people, nothing happens, not even control freak banks and governments. But we are so accustomed to being overlooked, our value under-estimated or dismissed, that there’s little push back when our value is systematically marginalized through monetary policies orchestrated by a small group of people who see themselves “above the law,” with the rest of us being subject to it.

Bitcoin and its alt-siblings are not money.

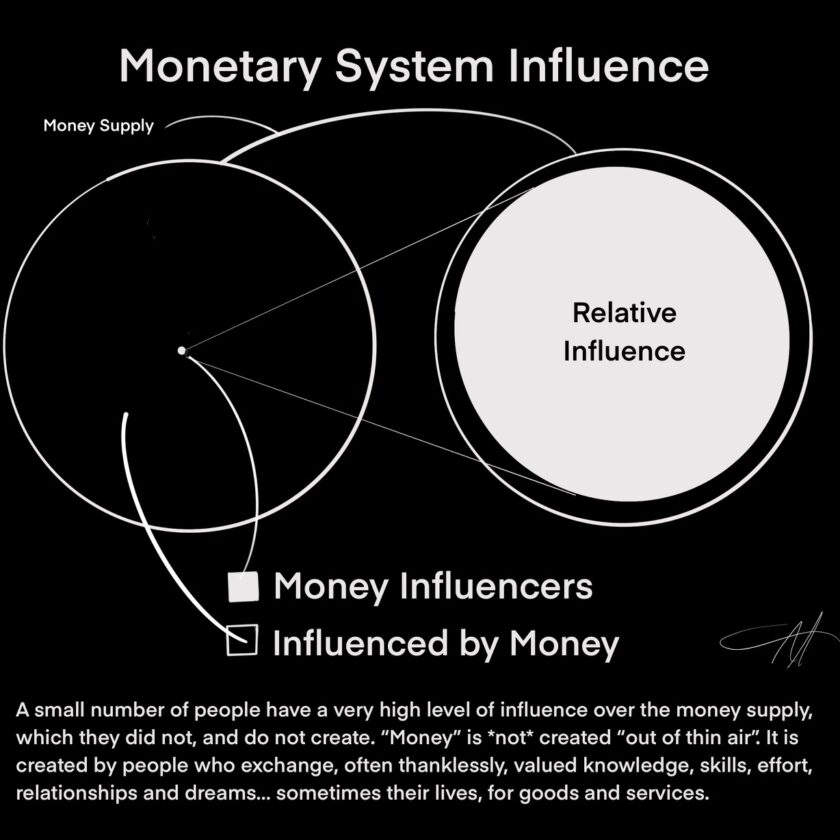

What a blessing! But will enough people appreciate this simple distinction to stand up when government agencies or banking entities claim entitlement to treat an individual’s cache or store of Value Instruments as though its theirs to seize? They got away with this ploy when they confiscated gold from the public (1933), *requiring* each to deliver take it to the Federal Reserve Bank.

This was grand theft; tyranny on a large scale, but Roosevelt has been characterized as a hero by the history writers.

Bitcoin is not gold, nor is it money. In fact, bitcoins aren’t any “thing”, yet through instructions with which they are endowed, they hold and protect an exchange of value between people. The people *are* the value, and creators thereof, which can’t be taken or usurped by any outside agency.

Sometimes We Argue for Our Limitations

However, people can be *convinced* that they have little or no value, except through their compliance to someone else’s opinion or beliefs. We put our children in schools that drill those perceptions in them, after we allow them to inject chemicals into their body that affects both their cognitive abilities and health. These are just some of the residual effects of value dissociation syndrome (VDS).

Money has an owner, and it is never us, no matter how hard we may work for it. It will always be “owned” by someone or some thing else.

I would hate to see someone or some thing try to take control of the alt-coin space, or insinuate that their “coin”, which has controls that artificially limit availability and invade privacy, is like or better than bitcoin. That would be sad we don’t know, care about, or appreciate and can explain the difference between value instruments and money.