For all the actions that humankind has taken to create a devolutionary spiral to the lowest depths of a civilizational abyss (although I’m sure we can go lower if we try), a doorway will always appear that will allow the astute and willing to save themselves from a fate that would befall an obedient, distracted, complacent, stubborn, or unthinking herd. The mechanism of said doorway is the proclivity toward balance that is constantly at hand in all manner of existence and creation.

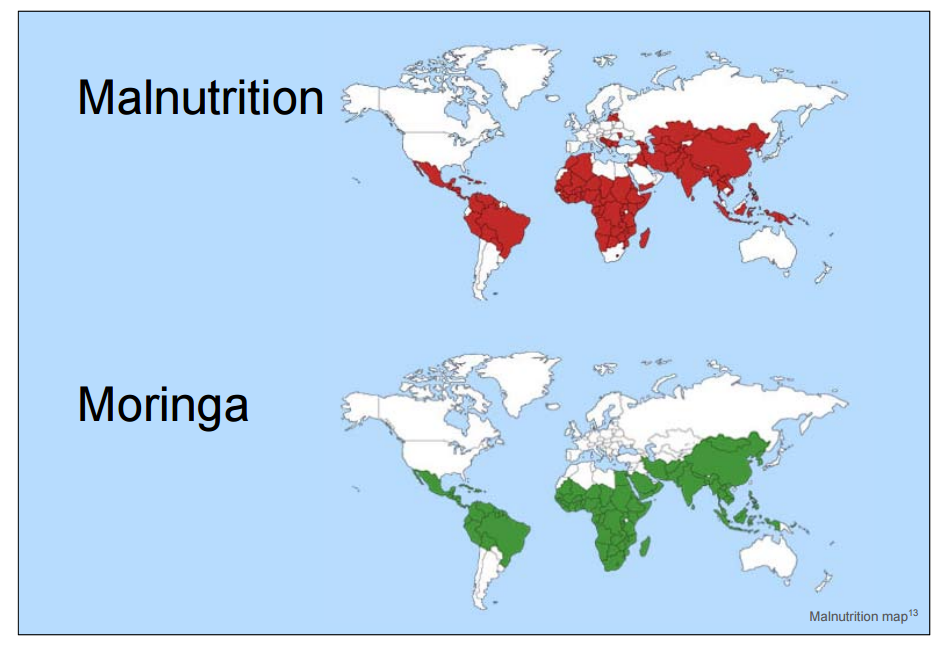

An example of this phenomenon is moringa olifera.

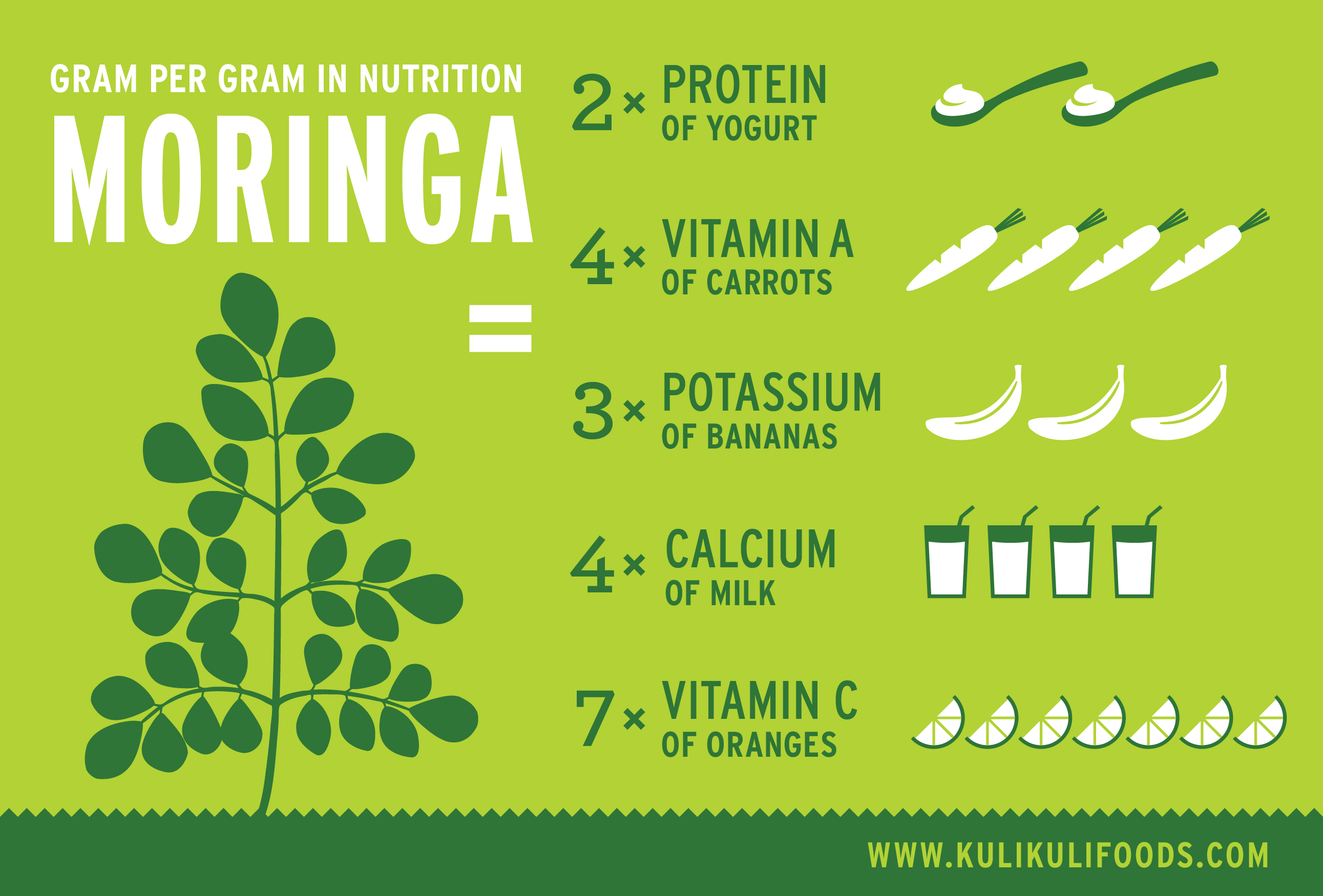

Referred to by some as the tree of life, Moringa Olifera is not just one of the world’s most nutrient dense plants, Science Daily pegs it as the world’s most useful tree. In addition to its strong nutritional pedigree, its seeds can even be used in such diverse areas as water purification and treatment, lowering bacteria counts by 90%-99% in untreated water, and mineral separation in industrial mining practices.

The irony is that this plant flourishes in areas where famine, poverty, pollution and disease are high, yet its adoption is, in contrast to the need and benefit that it portends, very low.

Today we have a similar dichotomy in the world of money. However, unlike Moringa Olifera, which has been known and used for over 5,000 years, we have had few choices with respect to money. In theory, money is a vehicle for the exchange of value. In practice, money has been a tool of divisiveness, and a vampire, rather than protector of value.

Changing a Not-So-Funny ‘Game’

My recent awakening to the evolution of bitcoin is a massive ray of hope that we now have a mechanism that is mature enough to help humanity to change the game.

If you haven’t taken a fresh look at what is called “digital” or cryptocurrency in general, and the one known as bitcoin in particular, please do so now. I have been so immersed in it lately; not only in the newness of it all, but how viable and vast it is, and each day, how important the migration of each individual is to each of us.

Almost two weeks after ending a water-only fast at the 50% mark of my original goal on Easter’s Eve, my body appears to have “normalized” at around 180 lbs (from 209 lbs in January), where it has been for several weeks now.

Della has concocted new discoveries for my taste buds, including a custard-like delicacy that consists of yogurt, whey protein powder, and just a titch of orange extract, and it rivals any dessert or snack treat I have ever tasted!

On April 15, I weighed 160 lbs and didn’t feel that great. That was when my body told me “no mas“, it was time to add food once again. On April 29, 2 weeks later, I weigh in at 180 lbs. Now, on May 16, I’m still in that range.

That’s the first part of the video below:

But it’s not the major point of my monologue. That subject is money, or the idea of money as we presently perceive and experience it.

The “Coin” that Isn’t

Even as I went through the changes associated with the fast I learned about an entirely new and “private” monetary system that has sprouted and matured over the past 10 years. It is called “cryptocurrency”, the main example of which is referred to as bitcoin.

When bitcoins were first introduced in 2009, they had little value as a currency. You could buy 10,000 bitcoin (BTC) for $1. Today, after a feverish push above the $1800 price point, and even over $2,000 in some countries, the price of 1 BTC has stabilized for a time around $1,725. When I first started writing this entry a few weeks ago, the price of 1 BTC was $1,325. While time flies, the price changes every 10 minutes; and on the whole it is on an upward move.

For all of this growth and maturity, few people know, or see much value in bitcoin. When they hear the price, it’s easy to assume one doesn’t have much chance of obtaining any, nor why they should. However, there are many reasons, some of which I’ll cover as we go.

Acne Stage Money

Actually, the bitcoin and “altcoin” space is just getting out of the sandbox phase. Even at its unprecedented price levels, bitcoin is still brand new; so brand new in fact, that to call it “mature” is a bit premature.

That said, there are many reasons why people should obtain and use bitcoin. Those reasons have fueled its steady rise in price.

The more I learned, the more it dawned on me that, as a “money” vehicle, bitcoin is mature enough to allow people to “live” with it, and on it.

I have made it my goal to transition from the traditional and “false” money that we’re accustomed to, to this virtual, but real one.

A New Money Platform and Paradigm

There is so much to discover and learn! Debit cards can now be attached to a bitcoin wallet, and be used anywhere Visa or MasterCards are honored. They can be used in regular ATM machines and get cash at any time, as long as enough bitcoin are in the account.

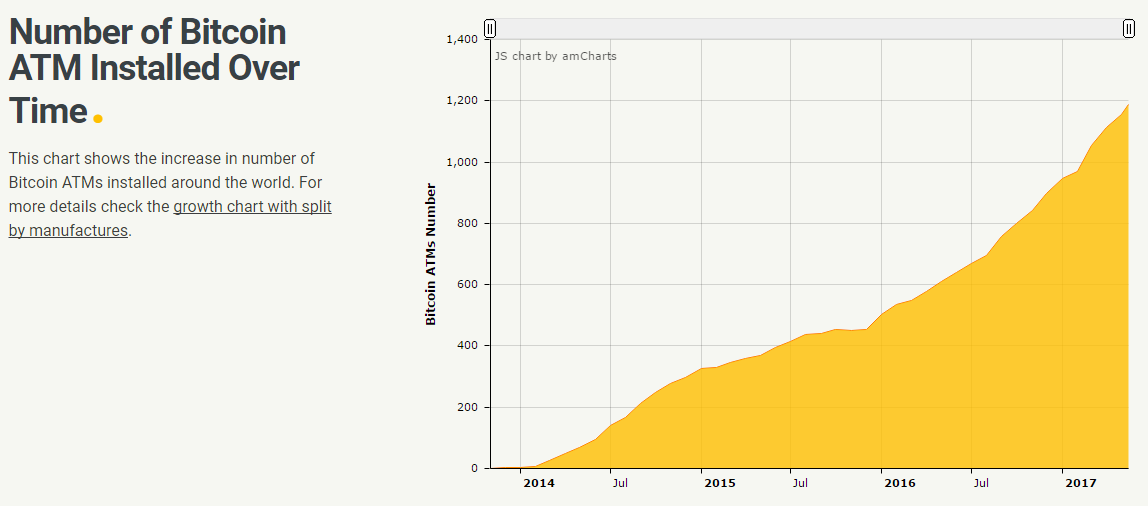

There are even bitcoin ATM’s, where you deposit cash and receive bitcoins. This is one place where the United States is actually “leading” in a beneficial way. We apparently have many more bitcoin ATM installations than any other country.

I captured this chart from the CoinRadar site, but I found another site several weeks ago proclaiming that there are over 6,000 bitcoin ATMs in Mexico. The article said that you could go to 7-Eleven or Oxxo service stations throughout the country and exchange pesos for BTC. I found the reference on a Reddit bitcoin thread weeks ago, and read the actual article. when I checked the link today, the article site is no longer active.

Hmmm.

Time for Us to Notice and Take Action

All of this is to say that bitcoin is something you (everyone) should begin to engage (get to know how to use) as well as accrue/accumulate. It is the digital currency that has paved the way for others that will follow.

Bitcoin and its ilk are called “cryptocurrency” because all bitcoin transactions occur in an encrypted, pseudonymous environment. Not totally or purely “anonymous” (at least as far as bitcoin is concerned), the level of encryption makes the owner of the transaction and amounts traveling through the network undetectable. Each transaction is private and protected from intrusion by banks or government agencies.

This is where you hear all types of babble from protectors of current monetary practice about “criminals” and “terrorists”, a preoccupation they very likely structured anticipating this august day and time. While politicians and bank executives obsess about such possibilities in public, it’s likely that they themselves are some of the largest users of blockchain services.

A case in point might be the Pentagon, which according to this FOXNEWS article, “lost” or “misplaced” $6.5 trillion in 2016. Here is the actual report published by the Department of Defense Inspector General.

None of the presidential candidates “noticed” or commented on this. Upon election and installation in office, Donald “Drain the Swamps” Trump, proposed a $54 billion increase in military spending, which some legislators claimed was not enough.

Only of you’re planning more terror, war and conflict, and have no intent to actually solve our differences peacefully. (Maybe the differences are just for “show”, to convince us to give up more of our privacy, value, and control over our lives?)

Mr. Trump hasn’t said a peep about what was presented as a $6.5 billion accounting gaff. No such thing.

There was little comment or outrage about this in mainstream media. But you can try to cover up lies, or ignore outright tyranny that’s hiding in plain sight, for only so long.

So back to bitcoin

The price of bitcoin has risen so dramatically, enough so as dissuade many from looking into its deeper implications. Like me, when first introduced to bitcoin when it was $600, few will ask questions as to how to get involved when the price is $1,700, or $3,000 and higher, like many analysts are projecting.

So if it becomes the greatest exchange of wealth in the history of the planet, as some have said, it would be only between those who already have wealth. They won’t care about bitcoin being “forbidden” or the stigma that “criminals” might use it. The word “above the law” applies to them (just ask them).

This is a good moment to pause and contemplate just what or who “the law” is actually intended for, and why.

A Fundamentally Different Animal

That being said, a nascent monetary system, an entirely different financial paradigm, complete with new behaviors, potentials, and protections, is here. However, our first inclination is to judge it by expectations and experience that we’ve endured with the present system.

This is where we do ourselves a great disservice.

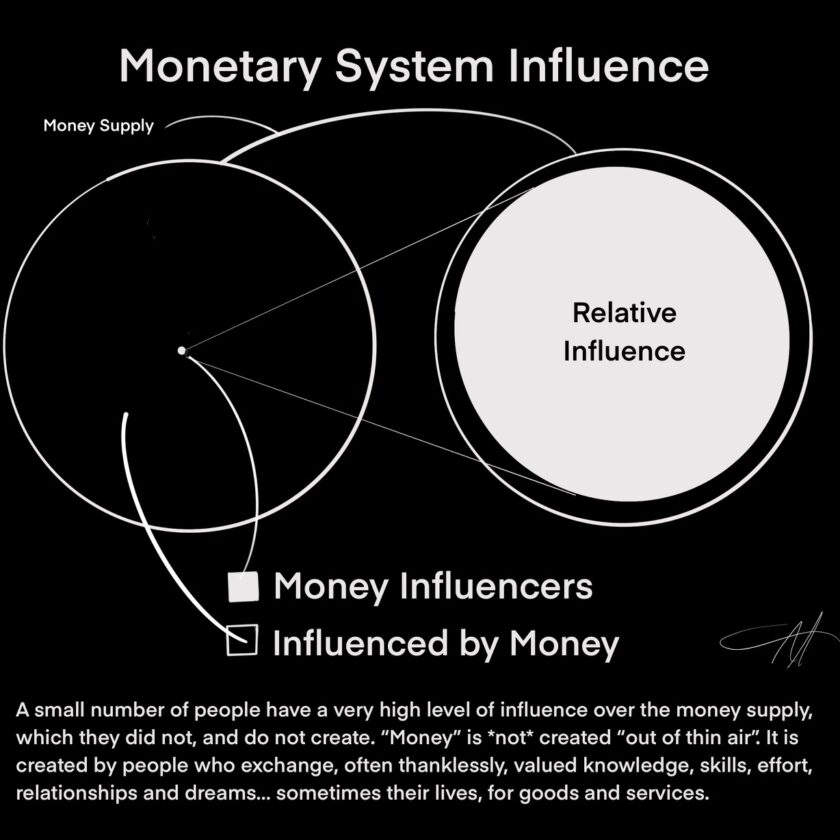

Thinking that “money” behaved as it does because that’s what it does, is not the same as understanding that it behaves as it does as a result of willful and institutional manipulation.

The “trust” that we placed in these institutions are the result of the total control and therefore, the absence of choice by which to compare.

In owning virtually all the central banks of the world, the organization/people that runs the Federal Reserve, create the same scenario in every country where money supply, and hence debt, is managed.

Bitcoin has been a welcome and needed breath of fresh air I didn’t know was available, and most people still think doesn’t exist.

There is so much to learn, discover, and get acquainted with in this New World of Money.

As such, I have made ti a priority to learn:

- ways to collect, accrue, and earn bitcoins,

- how to exchange (send and receive) bitcoin for goods (food), products, and services,

- how to protect my “assets”, which include maintaining our passwords, protecting wallets from any unwanted entries, and

- how to implement bitcoin acceptance on web sites and interactions of all types.

Figuring Della and I are not alone, I created a web site: www.bitcoinaccrual.com, which shows just some of the resources that we’ve discovered so far. We haven’t begun to scratch the surface. There are many more.

The purpose of the site is to introduce these many tools to a public that, at the moment, isn’t noticing.

Product of the Different Animal: “Bitcoin Accrual” Sites

Medicine, law, and money are three cryptic professions of the bizzaro world in which we have grown familiar. The investment world tends to add its own layer of mystery to the outsider, but is yet constrained by limitations imposed by regulators of the currencies, stocks, bonds, and commodities traded.

Web sites that, through various means, “accrue” bitcoins for their members, have existed for several years. Many have come and gone. However, they are easily dismissed by established investment advisers for a number of reasons;

- they take “money” out of the existing system

- advisers know (and care) little about bitcoin

- yield performance

- investment activity and investors go “dark”

Do you see how this might be considered, just a tad “disruptive?”

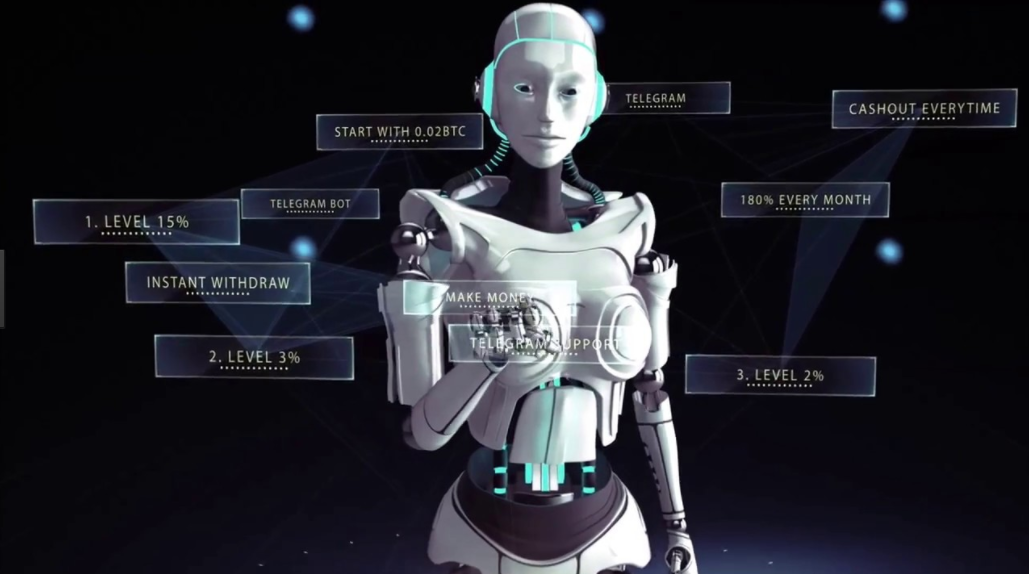

The bitcoinaccrual.com web site also introduces two bitcoin-based “investment” platforms (with more to come) that accept member deposits (in bitcoin) and return percentages that are unheard of in traditional investment strategies.

The two platforms are Gladiacoin and Wallet Pllus. Della and I have small positions in both. So far, they are performing as promised. A referral link is required for entry. When you share them with others who elect to enroll, your income from accruals increase.

I have already written more about two of these environments, but here is a thumbnail.

Gladiacoin, based in Singapore, uses trading arbitrage to disburse profits on member deposits at a rate of 2.2% daily. This accrual rate doubles a member’s deposit in 90 days, even if one chooses not to “recruit” others to join. Compare that to a 2.0% annual percent yield (APY) that would be offered in a “high yield” money market investment, which the bank would offer in exchange for a high balance, and a commitment of 5 years or more.

Brazil-based Wallet Pllus takes the Gladiacoin model a step further, delivering 3.3% daily accruals for a doubling of deposit in 60 days. Accrual rates are accelerated, and earnings increased when others sign up as a result of your referral.

While we took positions in Gladiacoin, and people are reporting significant bitcoin accrual with it, we concentrated our efforts on Wallet Pllus once we learned of it. I have no problem being in both, and in others as well.

If you’ve heard of BetRobot, or seen some of the videos on YouTube about it and haven’t joined, you can start by clicking this referral link. You will need to download the Telegram app for your Android or iOS phone, then activate the program, which runs within Telegram.

With Gladiacoin and Wallet Pllus, “recruiting” others is well rewarded, but not required. A substantial income can begin to accrue without doing anything. BetRobot is so automatic and efficient, it is ridiculous (in a very good way).

Shaking Up the ‘Status Quo’

When you watch the “bitcoins” in wallet grow, and know that it not only has value, but value will most likely increase, it’ll be hard not to share with others.

For these reasons, accrual sites and the cryptocurrency world may be the larger threat that banks and governments fear, as much as they want you to think that ISIS or North Korea are a threat to our safety.

I have begun a series of video discourses on this subject. This is a playlist titled, “The New Money.”

Unlike all “money” that we have grown accustomed to losing value, one other phenomenon is happening with bitcoin: their value is increasing. In January, 1 BTC cost about $700, versus today’s price being roughly $1,000 higher. It won’t cost the price of 1 BTC to enroll in one of these programs.

We created a Wallet Pllus International Bitcoin Community on Facebook.

This is our Wallet Pllus referral link:

Once you enroll and activate your position (i.e., make your bitcoin deposit), you will receive your own referral link to send to friends or family too. That’s also what I like about this. You can buy a position for a child, grandchild, etc., and they don’t have to be expected to recruit or “sell” this idea. Yet, your deposit would begin accruing bitcoin for them too.

Are there controversies? You bet!

Are there questions? Damn right!

Is there opportunity in this new world? Absolutely, and if you don’t get in, you’ll never know what you can miss.

And that’s just the way factions in some circles want things to be.

So while we have been guided, or you might say herded toward a financial precipice, a doorway awaits our notice, and willingness to enter. The effort won’t need to be nearly as the picture above might suggest.

I’ll close now.